Your retirement plan is one of the most important preparations you can make for the future. Saving for retirement is also one of the many ways in which financial literacy is useful.

Check out these 4 retirement saving plans for freelance animators:

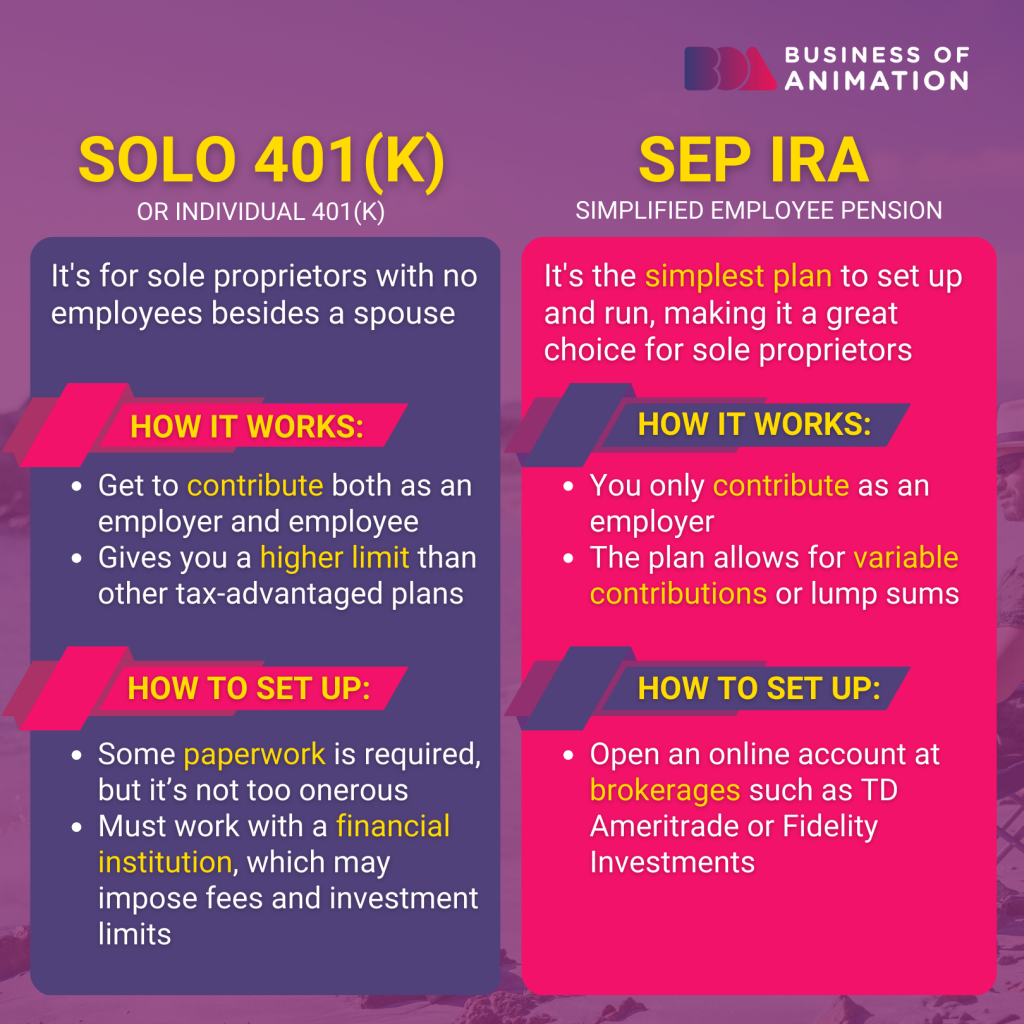

1. Solo 401(k)

The solo 401 (k) or individual 401 (k) is for sole proprietors with no employees besides a spouse.

How It Works

- Get to contribute both as an employer and employee

- Gives you a higher limit than other tax-advantaged plans

How to Set Up

- Some paperwork is required, but it's not too onerous

- Must work with a financial institution, which may impose fees and investment limits

2. SEP-IRA

The SEP-IRA is a simplified employee pension. It's the simplest plan to set up and run, making it a great choice for sole proprietors.

How It Works:

- You only contribute as an employer

- The plan allows for variable contributions or lump sums

How to Set Up:

- Open an online account at brokerages such as TD Ameritrade or Fidelity

Investments

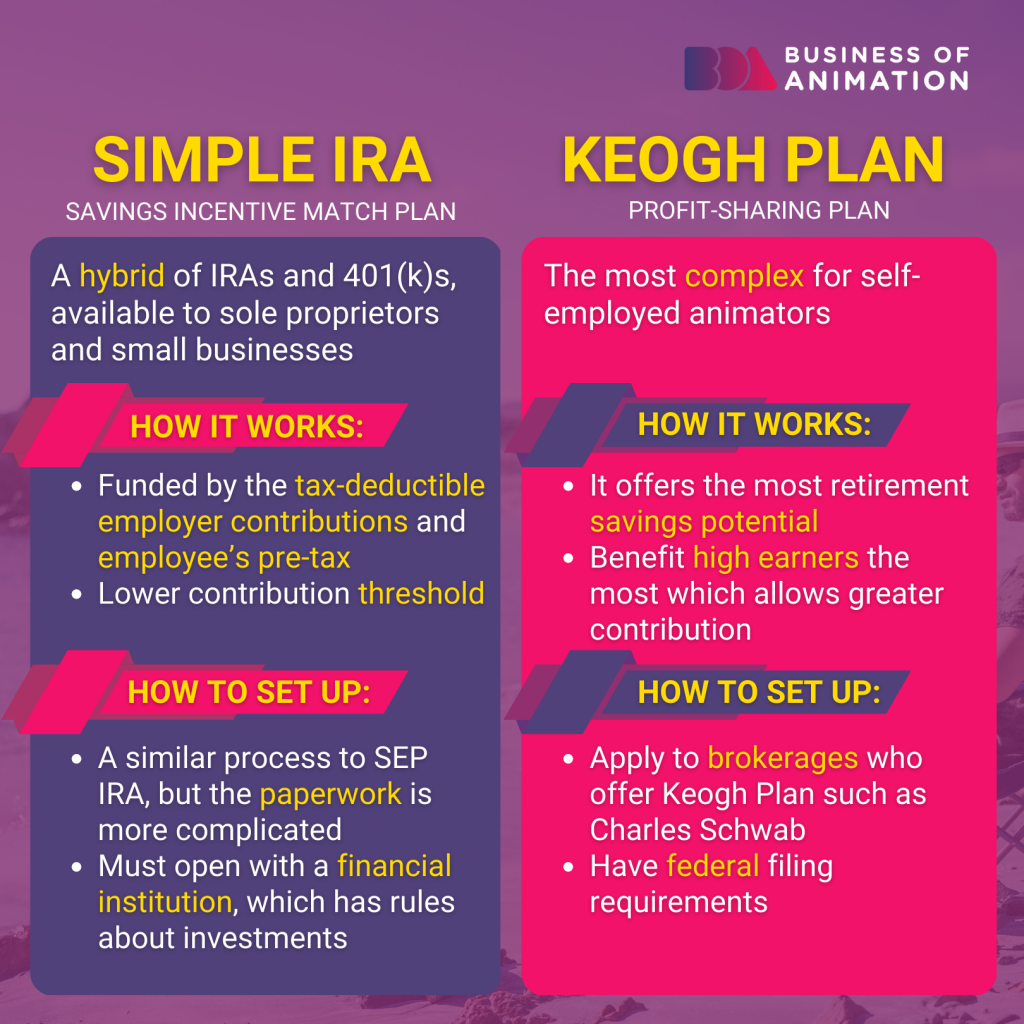

3. Simple IRA (Savings Incentive Match Plan)

A hybrid of IRAs and 401 (k)s, available to sole proprietors and small businesses.

How It Works

- Funded by the tax-deductible employer contributions and employee's pre-tax

- Lower contribution threshold

How to Set Up

- A similar process to SEP IRA, but the paperwork is more complicated

- Must open with a financial institution, which has rules about investments

4. Keogh Plan (Most Complex Retirement Saving Plan for Animators)

The most complex for self-employed animators.

How It Works:

- It offers the most retirement savings potential

- Benefit high earners the most which allows greater contribution

How to Set Up:

- Apply to brokerages who offer Keogh Plan such as

Charles Schwab - Have federal filing requirements

Not Yet Ready to Retire as an Animator?

Sign up for our FREE Masterclass!